Stop Tracking.

Start Living.

Your phone already knows what you spend. TapSpend just makes sense of it.

Tired of opening apps, typing amounts, picking categories, and forgetting half your purchases anyway? TapSpend captures every tap-to-pay transaction automatically, parses the details, and uses AI to categorize everything in real-time. Because budgeting shouldn't feel like homework.

Coming soon to Google Play Store

How It Works

Three steps. Zero effort. Your phone does what it already does—TapSpend just pays attention.

1. Tap to pay

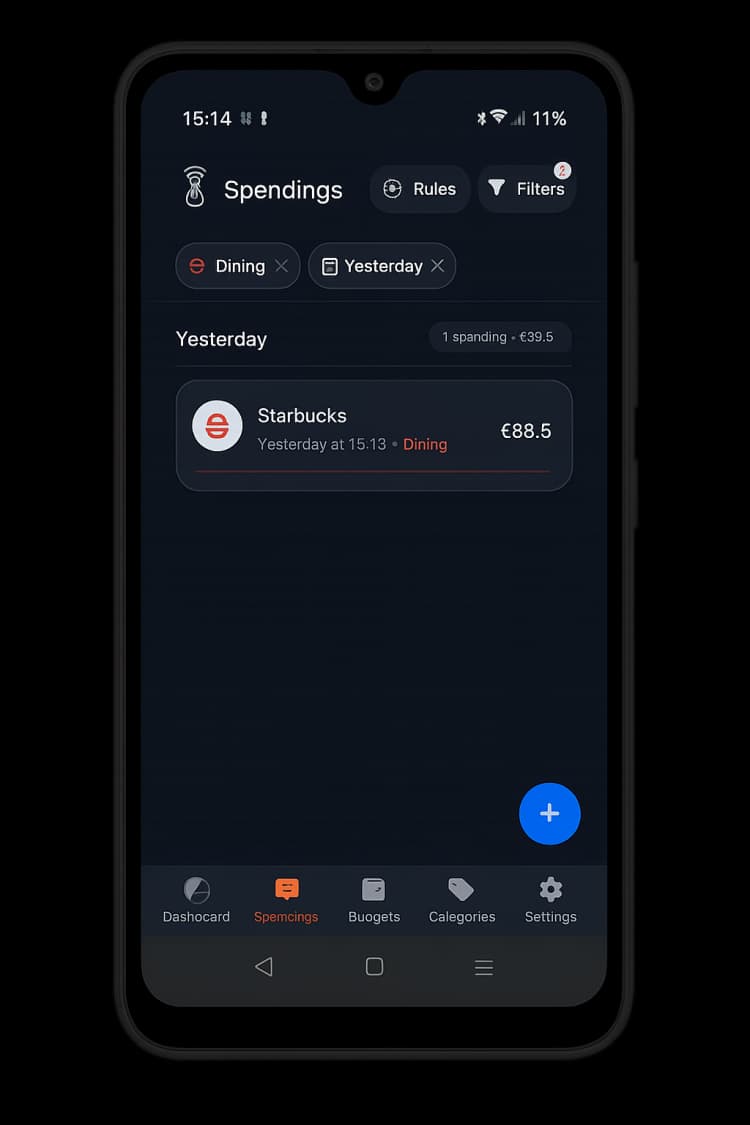

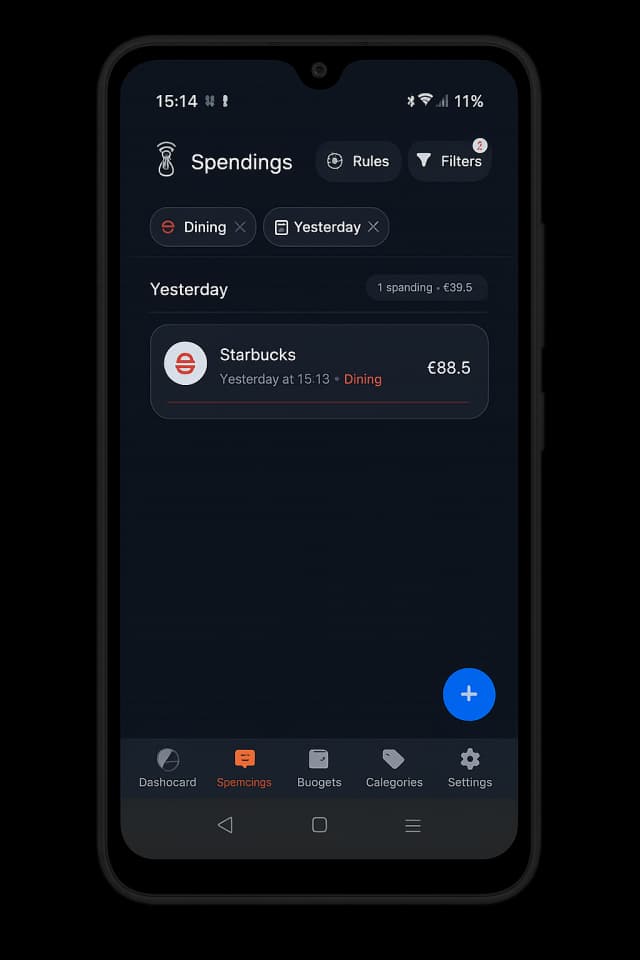

2. Auto-capture, parse & categorize

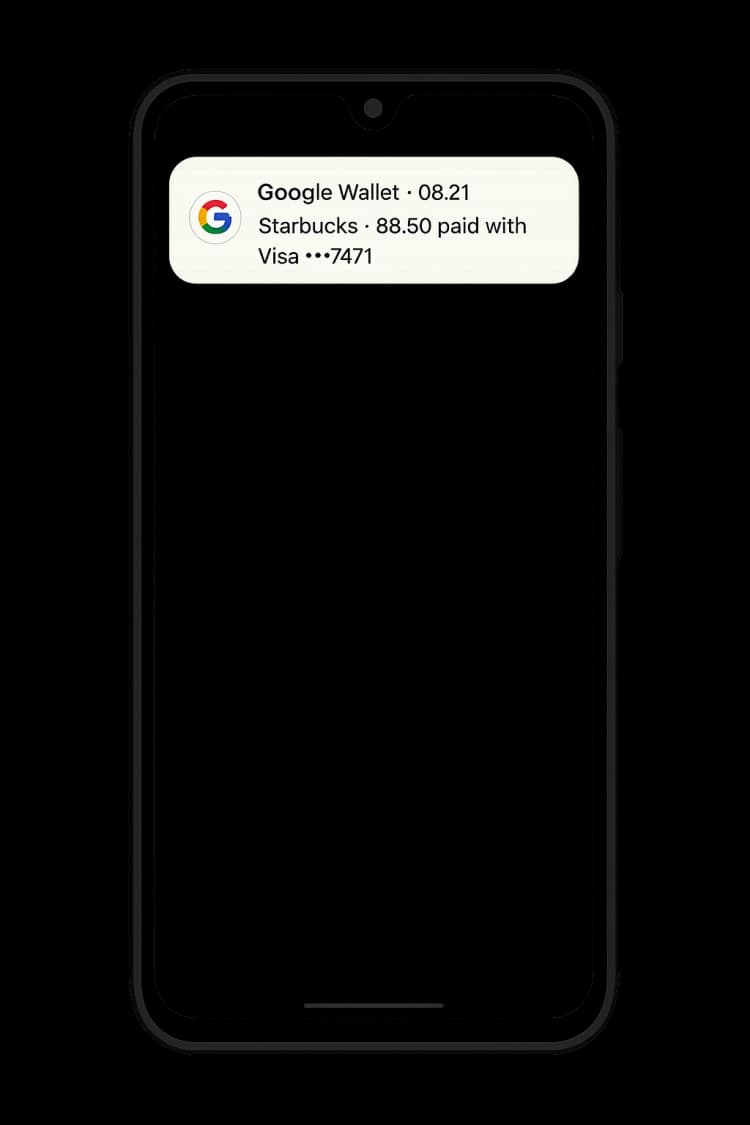

TapSpend captures the notification instantly

Google Wallet · 08.21

Starbucks · 88.50 paid with Visa •••7471

Parses what matters—merchant and amount

Merchant

Starbucks

Amount

€88.50

AI figures out the category automatically

Category

Food & Dining

3. Log in the application

Built on Trust, Not Tricks

TapSpend works differently because it has to. Here's what you need to know.

Why Android Only?

iOS doesn't allow apps to read notification content from other apps—it's a hard limit by Apple. Android does, but you have to grant explicit permission. This isn't a limitation of TapSpend; it's how mobile operating systems protect your privacy. We're working within the rules that exist.

What Permissions We Need

TapSpend needs Notification Access to read payment notifications. That's the only permission required.

We don't ask for contacts, location, camera, or anything else. Just notifications—and only to track your spending.

Your Data Stays on Your Device

Everything TapSpend captures stays local. We don't send your transactions to the cloud, sell your data, or track your spending habits for ads.

Your financial data is yours. Period.

Yes, Setup Takes a Minute

Android makes you jump through a few hoops to grant notification access—and honestly, that's a good thing. It means apps can't just grab your data without asking.

We'll guide you through every step. It's worth the 60 seconds to never manually log expenses again.

Built by One Person Who Gets It

TapSpend isn't made by a faceless corporation. It's built by someone who got tired of budgeting apps that make simple things complicated. No dark patterns. No hidden fees. No data harvesting. Just a tool that does what it says and respects your privacy.

Features That Just Make Sense

Built for real people who want control without the complexity.

Works With Any Payment App

Google Wallet, Apple Pay, your bank, credit cards, digital wallets—if it sends payment notifications, TapSpend tracks it. One app for all your spending, no matter how you pay.

Manual & Voice Logs

For cash payments or offline transactions, quickly log expenses manually or simply speak them. AI understands and categorizes your voice entries instantly.

Custom Categories

Create personalized spending categories and define custom rules. Train the AI to understand your unique spending patterns for smarter, more accurate categorization.

Smart Dashboard

Visualize your financial story with intuitive charts and actionable insights. Discover spending trends, identify savings opportunities, and make informed decisions.

Budget Control

Set flexible budgets by category or time period. Get smart alerts before you overspend and stay on track with your financial goals effortlessly.

Recurring Transactions

Never forget subscriptions or regular payments. Set up recurring transactions that auto-log monthly rent, utilities, or any periodic expense you need to track.

Works With Any Payment App

Google Wallet, Apple Pay, your bank, credit cards, digital wallets—if it sends payment notifications, TapSpend tracks it. One app for all your spending, no matter how you pay.

Manual & Voice Logs

For cash payments or offline transactions, quickly log expenses manually or simply speak them. AI understands and categorizes your voice entries instantly.

Custom Categories

Create personalized spending categories and define custom rules. Train the AI to understand your unique spending patterns for smarter, more accurate categorization.

Smart Dashboard

Visualize your financial story with intuitive charts and actionable insights. Discover spending trends, identify savings opportunities, and make informed decisions.

Budget Control

Set flexible budgets by category or time period. Get smart alerts before you overspend and stay on track with your financial goals effortlessly.

Recurring Transactions

Never forget subscriptions or regular payments. Set up recurring transactions that auto-log monthly rent, utilities, or any periodic expense you need to track.

Ready to Stop Tracking?

TapSpend is launching soon on Google Play. Your stress-free budgeting journey is almost here.

Coming soon to Google Play Store